A sales pipeline is more than a set of stages in a CRM. It’s a clear, visual way to understand how deals move from first contact to closed revenue. When built correctly, a pipeline helps sales teams stay focused, forecast accurately, and spot problems before deals stall. When it’s poorly designed, it creates confusion, missed follow-ups, and unreliable projections.

For growing teams, having a structured sales pipeline is essential. It brings consistency to how leads are handled, aligns sales and marketing efforts, and gives leaders real visibility into what’s happening across the funnel. In this guide, we’ll break down what a sales pipeline really is, why it matters, and how to build one that supports predictable growth rather than slowing down your team.

What Is a Sales Pipeline?

A sales pipeline is a live, visual overview of every deal your team is currently working on. Think of it as a real-time map showing exactly where each opportunity sits on the path from initial contact to signed contract.

Picture a board or dashboard where each column represents a stage in your sales process. Each card on that board is a real opportunity with a deal value, a target close date, and a clear next step. Your sales reps can see briefly which deals need attention today and which are progressing smoothly toward the finish line.

Here’s a simple example. An account executive at a B2B SaaS company in 2025 opens their CRM and sees 40 open deals spread across discovery, demo, proposal, and negotiation stages. Within seconds, they know exactly which conversations to prioritize and how many deals are likely to close this quarter.

Compare that to the old spreadsheet approach. Rows and columns get messy fast. Close dates slip without anyone noticing. Deals fall through the cracks. A dynamic visual representation of your pipeline makes it easier to manage opportunities, coach your team, and track progress without hunting through endless tabs.

Sales Pipeline vs. Sales Funnel

These two terms get used interchangeably, but they answer different questions. Your sales pipeline answers “What are we actively working on right now?” Your sales funnel answers “How many people are moving through our buying journey?”

The sales funnel shows the full purchasing process from first awareness to final purchase. It tracks conversion rates at each step and helps marketing understand where potential buyers drop off. The sales pipeline, on the other hand, focuses on active deals and the specific actions your sales reps take to move them forward.

Here’s a concrete example. Your marketing team might track 10,000 website visitors who become 1,000 leads, then 100 marketing qualified leads, and finally 35 sales qualified leads. That’s your funnel. Your sales team then takes those 35 SQLs and works them as pipeline deals, tracking each through discovery, demo, proposal, and close. That’s your pipeline.

In most modern go-to-market organizations, sales and RevOps own the pipeline view while marketing leans more heavily on funnel metrics. But here’s what high-performing teams understand: these views work best together. When sales leaders and marketing align on both perspectives, they can set realistic sales targets and build campaigns that fill the pipeline with qualified leads.

The sales funnel shows the volume and flow. The sales pipeline shows the execution. Both matter for hitting revenue goals.

Why a Sales Pipeline Matters for Revenue Teams

Imagine you’re a VP of Sales planning 2026 revenue targets. Without clear pipeline visibility, you’re guessing. With it, you can see exactly how many deals you need at each stage to hit your number next quarter.

A healthy sales pipeline supports accurate sales forecasting for the next month, quarter, and full year. When you know your average sales cycle length and typical conversion rates, you can work backward from your revenue targets. Need $500K in Q3 2025? If your average deal size is $25K and your win rate is 25%, you need at least $2M in pipeline to feel confident.

Sales managers use the pipeline to identify bottlenecks before they kill the quarter. Maybe deals keep stalling in proposal for 30+ days. That’s a signal. Perhaps reps need better proposal templates, faster legal review, or coaching on handling objections during negotiation.

For sales reps, pipeline visibility means better prioritization. Instead of treating every opportunity the same, they can focus on high-probability deals moving forward while keeping lighter touch on earlier-stage conversations. Fewer forgotten leads. Less wasted time on potential customers who were never going to buy.

The impact extends beyond sales. Finance trusts forecasts more when real pipeline data back them. Marketing can see which channels create opportunities that progress through the sales stages. Everyone makes better decisions.

Core Stages of a Sales Pipeline

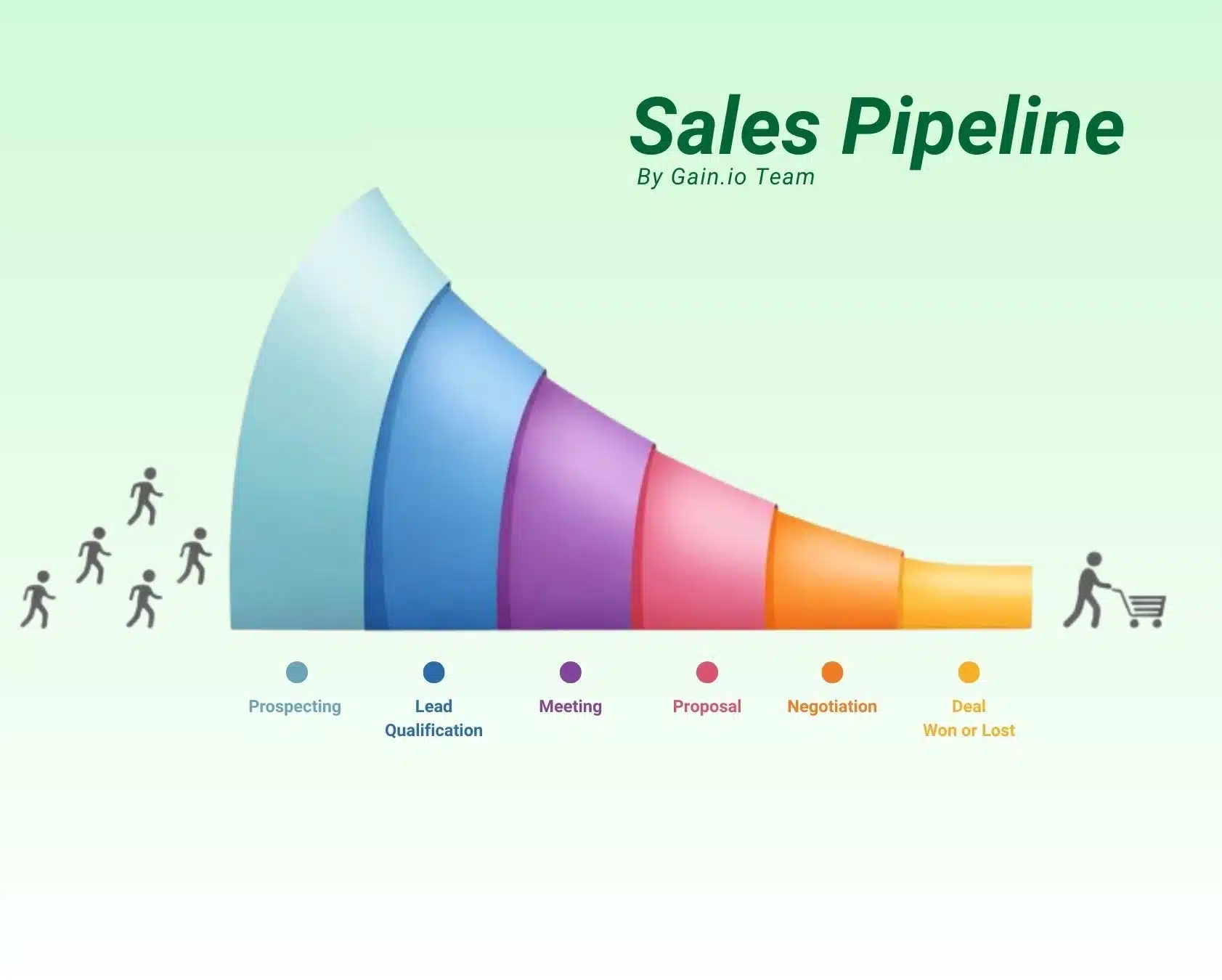

Most B2B sales pipelines in 2024-2025 share similar DNA, even if the labels differ by company or industry. You’ll typically see six to eight sales pipeline stages that reflect the natural progression from stranger to customer.

The typical flow looks like this: prospecting, lead qualification, discovery or demo, proposal, negotiation and commitment, closing, and post-purchase relationship building. Some teams split these further. Others combine steps. The key is that your stages of a sales pipeline match how your buyers buy.

Let’s walk through each stage with real-world examples that sales professionals can apply immediately.

Prospecting

Prospecting is the daily work of finding potential customers who might benefit from your product or service. It’s outbound emails, cold calls, LinkedIn outreach, event networking, and asking for referrals.

In 2025, an SDR team might use LinkedIn Sales Navigator combined with intent data to build a list of 200 target accounts per month. They’re looking for companies that fit the ideal customer profile and show buying signals like recent funding, new hires, or technology changes.

The focus at this stage is pipeline volume and fit. You’re not running deep discovery calls yet. You’re identifying potential deals and getting enough of them into the pipeline so you don’t hit a dry month three months from now.

Good prospecting prevents revenue shortfalls later. It’s the fuel for everything that follows.

Lead Qualification

Lead qualification is the filter that decides which leads become real opportunities worth pursuing. Not every conversation should become a deal in your pipeline.

Most sales teams use frameworks like BANT (Budget, Authority, Need, Timeline) or MEDDIC to standardize qualification. The goal is simple: confirm this lead has a real problem you can solve, the budget to pay for it, and a timeline that makes sense.

Here’s what a qualification looks like in practice. A rep gets on a 15-minute intro call and confirms the prospect has budget in the $20K-$40K range, wants to decide before Q4 2025, and that the person on the call can bring in the final decision maker. Those answers move the lead to the next stage.

Strong qualification improves win rates and makes your sales forecasting more believable. It also saves reps from wasting weeks on opportunities that were never going to close.

Discovery Call or Demo

This stage turns a qualified guess into a clear understanding of the prospect’s problems and priorities. It’s where real sales conversations happen.

In 2024-2025, most B2B discovery calls run 30-45 minutes over Zoom. Reps ask thoughtful questions about current challenges, desired outcomes, and decision-making processes. They share a tailored demo that addresses the specific pain points they’ve uncovered. Before the call ends, they agree on concrete next steps.

Deals only move to the next stage once the prospect confirms genuine interest in a specific solution. A polite “this looks interesting” isn’t enough. You need commitment to a follow-up meeting, a proposal review, or bringing in additional stakeholders.

This is where deals are won or lost. The reps who excel here log key insights in their CRM immediately and use that customer data to personalize every future interaction.

Proposal

The proposal stage is when pricing, scope, and implementation details get documented and shared. It’s your official sales offer in writing.

A SaaS vendor might send a tailored proposal outlining license costs for 50 users, a two-week onboarding timeline, and a 12-month contract value of $36,000. The proposal addresses the specific needs uncovered during discovery and shows exactly how implementation would work.

Fast follow-up matters here. Many deals fall apart in the proposal simply because the prospect went quiet and the rep didn’t stay engaged. Send the proposal, then follow up within 24-48 hours to answer questions and confirm next steps. Clear summaries prevent the dreaded silence.

Negotiation and Commitment

Negotiation covers the details that need resolution before a deal can close. Price, contract length, payment terms, legal clauses, implementation support, and any special requests.

This stage shows the human side of sales. You’re handling objections, involving legal and procurement teams, and staying responsive while multiple stakeholders review the agreement. Some B2B negotiations wrap up in a week. Others take several weeks as contracts pass between legal teams.

Commitment might look like a verbal yes on a call, an email confirmation from the economic buyer, or internal approval before signatures happen. Your job is to keep deals moving forward by removing friction and addressing concerns quickly.

Closing and Post-Purchase

Closing is the moment contracts get signed, often via e-signature tools like DocuSign, and the opportunity moves to “closed-won” in your pipeline. Payment terms kick in. You hit your sales quota.

But a strong sales pipeline doesn’t end at close. Post-purchase stages like onboarding, adoption, and renewals are where long-term value gets proven. Many teams hand off to customer success within 24-48 hours of signing to ensure new customers get the attentive service they expect.

Your existing customers are your best source of referrals, expansions, and case studies. A pipeline that ignores post-sale stages leaves money on the table and risks churn.

How to Build Your First Sales Pipeline

You don’t need complex software to sketch version one of your pipelines. A whiteboard, a shared doc, or a simple spreadsheet works fine for small teams just getting started.

The sequence is straightforward: map your real sales process, name your stages, define entry and exit criteria for each, then load in your current deals. A small B2B team or agency could work through this in an afternoon workshop.

Let’s break it down.

Map Your Real Sales Process

Start by looking at deals you closed in 2023-2024. Write down the steps each deal went through, in order. What happened after the first meeting? When did you send a proposal? What triggered the final signature?

The goal is to capture reality, not an idealized version from a training slide. Your actual sales process stages might include steps like “waited for procurement approval” or “sent ROI calculator” that don’t appear in textbook examples.

Involve your sales reps, SDRs, and marketing team in this exercise. Each perspective reveals something different about how deals really move through your organization.

Define Clear Stages and Exit Criteria

Turn those real-world steps into six to eight pipeline stages with simple, action-based names. Avoid vague labels. “Contacted” tells you nothing. “Discovery Completed” tells you that a specific milestone happened.

Exit criteria make everything work. For example: “Qualification completed once the budget range and decision maker are confirmed in the CRM.” Or “Demo completed when prospect agrees to receive a proposal.” These criteria create consistency across your team and make coaching conversations much easier.

When one stage ends, the next stage begins. No ambiguity.

Estimate Deal Values and Close Dates

Every opportunity in your pipeline needs a realistic value and a target close date. These estimates drive your sales forecasting and capacity planning.

Look at your recent wins to calibrate. If most deals close in 60-90 days for mid-market SaaS, use that as your baseline. If the average deal size is $30K, don’t put $100K on an opportunity without a clear reason.

Early estimates will be imperfect. That’s fine. The point is having something to track and refine over time. As you close more deals, your estimates get sharper.

Choose a Tool to Track the Pipeline

Spreadsheets work for very small teams with fewer than 20 active deals. Beyond that, a proper customer relationship management platform makes life easier for everyone.

The right CRM gives you visual sales pipeline stages, easy updating after every meeting or email, and clear visibility for managers. Look for tools that integrate with your email and calendar, so updates happen automatically instead of requiring manual data entry.

Whatever you choose, the tool should support quick edits and clear visual stages. If updating the pipeline feels like a chore, reps won’t do it. And a pipeline that isn’t current is worthless for forecasting or coaching.

Key Metrics to Evaluate Pipeline Health

Healthy pipelines are measurable. Sales leaders who track the right numbers spot risk early and adjust before the quarter ends. Those who fly blind scramble in the final weeks.

Let’s look at the key pipeline metrics that matter, without turning this into a statistics textbook.

Core Pipeline Metrics

The number of deals in your pipeline reveals whether you have enough volume to hit targets over the next 90 days. If you need to close 10 deals per quarter and you only have 15 qualified opportunities, you’re cutting it close.

Conversion rates by stage show where deals get stuck. If 80% of demos turn into proposals but only 10% of proposals turn into negotiations, you’ve found a bottleneck. Maybe your pricing is off. Maybe competitors are winning at this stage. The data points you toward the problem.

Average deal size affects how you plan territories and set sales goals. If the typical contract value is trending up, you might need fewer deals to hit the target. If it’s dropping, you need more volume.

Sales cycle length measures days from the first meeting to the close-won. For many B2B teams, 60-90 days is typical. Tracking this helps you forecast when the current pipeline will convert to revenue.

Pipeline coverage is the total pipeline value divided by your sales target. Most sales leaders aim for 3-4x coverage. If you need $300K next quarter, you want $900K-$1.2M in the pipeline to feel confident about hitting the number.

Signals of a Stalled or Unhealthy Pipeline

Watch for warning signs. Deals stuck in one stage for more than 30 days often signal problems. Either the opportunity isn’t real, the prospect has gone dark, or something in your process is broken.

The phantom pipeline is another red flag. These are deals where close dates keep slipping quarter after quarter, but nobody moves them to closed-lost. They inflate your sales data and make forecasts unreliable.

To keep your pipeline healthy, conduct regular pipeline reviews. Weekly check-ins at the rep level. Bi-weekly or monthly team reviews focused on deal age, stage progression, and realistic close dates. Clean out opportunities that aren’t progressing. Your sales pipeline report should reflect reality, not wishful thinking.

Practical Tips for Day-to-Day Sales Pipeline Management

Effective sales pipeline management isn’t a quarterly clean-up exercise. It’s a daily habit that compounds over time.

Here are practical behaviors your team can apply every week.

Keep Deals Moving With Consistent Follow-Up

Most B2B deals require multiple follow-ups across channels before prospects make decisions. The number of deals you lose simply because someone didn’t follow up is probably higher than you’d like to admit.

Before ending any call, schedule the next meeting. Set reminders so no opportunity goes quiet for more than seven days without outreach. Consistent, helpful follow-up keeps deals moving forward instead of quietly expiring in your pipeline.

The goal isn’t to annoy prospects. It’s to stay relevant and helpful throughout their purchasing process. Share useful content. Answer questions quickly. Make it easy for them to move to the next stage.

Review and Clean Your Pipeline Regularly

Weekly rep reviews should cover every active deal. What’s the next step? When is it happening? Is the close date still realistic?

Monthly or bi-weekly team reviews should focus on deal age, stage progression, and pipeline accuracy. Be honest about which opportunities are real and which are zombie deals eating up attention.

When an opportunity is truly dead, mark it closed-lost. Keeping it in limbo hurts your sales data and makes everyone less confident in the numbers. A clean pipeline improves forecast accuracy and builds trust between sales, leadership, and finance.

Stay Focused on Buyer Needs at Each Stage

Every stage in your pipeline should map to a milestone in the buyer’s journey. Qualification matches their need to confirm you’re worth evaluating. Proposal matches their need to see pricing before seeking budget approval. Negotiation matches their need to finalize terms before signing.

Think about what your potential buyers need at each step to move forward. During negotiation, an ROI calculator might tip the decision. At the proposal, a detailed implementation plan might ease concerns about onboarding.

When your sales efforts align with what buyers need, deals close faster, and customers start the relationship with confidence.

How Gain.io Helps You Build and Maintain a High-Performing Pipeline

Building a sales pipeline is one thing. Keeping it clean, current, and forecast-ready is another challenge entirely.

Gain.io centralizes your pipeline data so your entire sales team works from one source of truth. Every deal, every stage, every next step lives in a visual pipeline that updates as you work. No more hunting through spreadsheets or wondering if the numbers are fresh.

The platform reduces manual admin by syncing emails, meetings, and notes directly into opportunities. When you send a follow-up email or complete a demo, your pipeline reflects that activity automatically. This means less time on data entry and more time on the sales conversations that close deals.

For sales managers, Gain.io makes pipeline reviews more productive. You see clear metrics, deal risk signals, and suggested next steps without digging through reports. Coaching conversations become specific and actionable because everyone is looking at the same accurate data.

The result? More accurate forecasts, fewer stalled deals, and a consistent path to hitting revenue goals in 2025 and beyond. If you’re ready to build a sales pipeline that works as hard as your team does, Gain.io gives you the visibility and simplicity to make it happen.

FAQ

What is the first step if our company has no formal sales pipeline yet?

Start by reviewing your last 10-20 closed deals and list the actual steps each one went through. Look for patterns in how prospects moved from first contact to signed contract. Those patterns become your initial pipeline stages. You can refine them later, but getting the basics in place based on real sales history is the fastest way to build a sales pipeline that reflects how you sell.

How often should we update our sales pipeline?

Sales reps should make quick updates daily or immediately after key interactions like calls, meetings, or sending proposals. Automate tasks where possible by using a CRM that syncs email and calendar data. Managers typically run structured reviews weekly to check deal progress, with deeper pipeline clean-ups happening monthly to remove stale or unrealistic opportunities.

Can small teams or solo founders benefit from a sales pipeline?

Absolutely. Even a solo consultant or early-stage founder can use a simple five-stage pipeline to track active conversations, schedule follow-ups, and estimate likely sales revenue for the coming months. The visual representation helps you stay organized without relying on memory, and it forces discipline around which opportunities deserve your limited time.

How many stages should a typical B2B pipeline have?

Most effective B2B pipelines use five to eight stages. Fewer than five usually means you’re missing meaningful milestones. More than eight often creates unnecessary admin work and confusion about what each stage means. The right number depends on your sales cycle length and buying process complexity, but simplicity wins when you’re starting out.

What is the difference between pipeline value and forecasted revenue?

Pipeline value is the total dollar amount of all open opportunities in your pipeline right now. Forecasted revenue adjusts that total based on stage probability and realistic close dates. For example, a $100K deal in early discovery might only count as $10K in the forecast, while the same deal in final negotiation might count as $80K. Forecast gives you a more realistic view of what you’ll close.